Tenant Protection

Tenant Protection

If you we’re unable to work could you pay your bills?

Tenant Protection

Don’t let serious illness, death, stress or injury lose you your home. If you were unable to work, how would you pay the rent?

- The average rent in the East Midlands is £586 (Per Deposit Protection Service April 2020)

- Then there are other outgoings – utility bills, council tax, mobile phone contracts, childcare costs…

- The average family savings pot is £3,494. How many months’ rent would your savings cover?

- Statutory sick pay is currently £94.25 a week. If you weren’t eligible for other assistance, would this cover your rent and bills?

COVER CAN BE AS LITTLE AS £5.00 PER MONTH, PER PERSON

Why is Tenant Protection Necessary?

Around 23% of households in the United Kingdom are in the private rented sector, with this proportion doubling since 2002. Although tenants homes maybe at risk if they are unable to pay the rent due to illness or the death of one of the householders, protection remains a rarity among renters.

Research by Sainsbury’s Bank found that while 41% of homeowners have life insurance or critical illness cover, just 26% of those renting have a similar policy in place.

It is estimated that only around 6.5% of income protection policyholders are in rented accommodation which potentially leaves many households dependent on their savings if they are unable to work due to long-term illness.

A Safety Net

Universal Credit is available to individuals unable to pay the rent themselves due to illness or the death of a partner. However, as the amount someone receives is determined by their income and savings, how many people they live with and the Local Housing Allowance rate, there is no guarantee the benefit will cover the rent.

Just how unlikely this is was illustrated by research by Shelter. Based on analysis of government figures, it found that as a result of private rents rising faster than the LHA rate, shortfalls are commonplace. The biggest is in London, however, outside the capital they could still be looking at an extra £531 of housing costs every month.

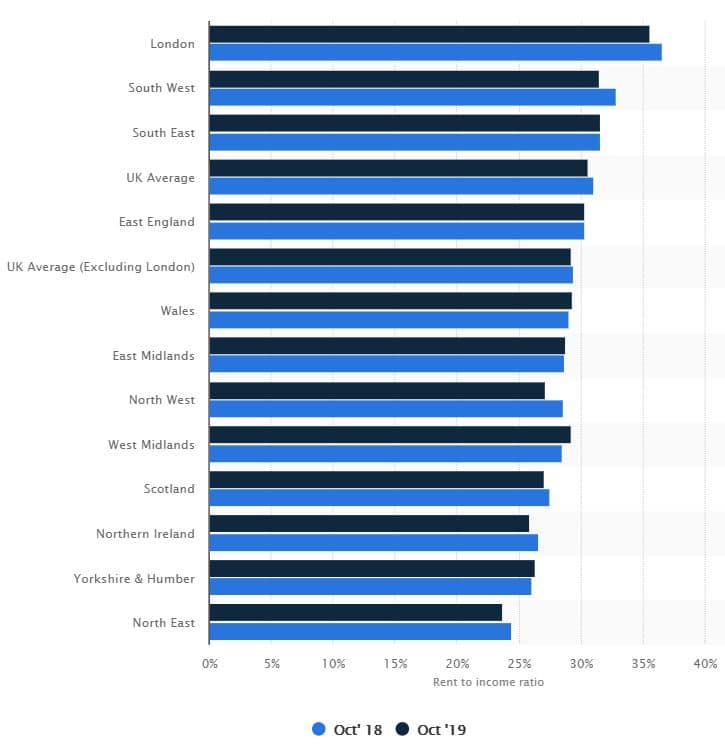

Adding further weight to the need for protection, information from Statista, the UK’s leading statistics provider, demonstrates how dependent renters are on their income. It found that, on average, just under 30% of the average salary is spent on rent in the East Midlands, with this figure climbing to over 35% for those renting in the capital. (Full regional figures can be seen on the graph).

Given that the English Housing Survey found owner-occupiers spent an average of 19% of their income on mortgage payments – a lot lower than rent payments, there is clearly a pressing need for renters to consider protection.

As well as a potentially larger liability, private landlords may not be quite so sympathetic as lenders when it comes to negotiating a mortgage holiday.

Falling between the Gap

Although their homes are potentially more at risk in the event of long-term illness or death, it is easy to see why renters are failing to take out protection: with most protection sold on the back of a mortgage, they are simply not discussing the protection conversation.

Renters tend to fall through the gaps a bit. A significant number of people rent their homes but the focus for financial needs tends to be on the mortgage.

The situation is exacerbated by the language used in protection literature, where the importance of protecting the home and mortgage is a common message. Although these policies are just as suitable for someone in private rented accommodation, this focus just isn’t there.

Our partner, Securehealth Ltd, can help protect your rent and your home.

Life Insurance*

Life insurance is designed to support your family financially when you’re no longer there for them.

The cover will pay out after your death, or if you’re diagnosed with a terminal illness. This can be a difficult thing to talk, or even think about, but it really needs to be considered.

It comes in the form of:

Term Insurance*

Term insurance is a type of life cover that lasts for a fixed period of time (‘term’) – the payout is made in one lump sum. It protects you against death and terminal illness until the last day of your policy.

Family Income Benefit*

Family income benefit is a cost-effective way to help your loved ones pay the bills when you are no longer there to help them yourself. It covers you for the same scenarios as our life term insurance, but pays out in monthly instalments instead. It could be a useful option when budgeting for ongoing costs.

Critical Illness Cover*

If you are diagnosed with a serious health problem, critical illness cover will ease the financial strain. Your financial concerns could be taken away, helping you focus on what really matters – getting better. How much you choose to insure is up to you, and the money from your critical illness cover can help you in lots of different ways. No matter how big or small your policy is.

Income Protection*

Income Protection is a type of insurance which provides you with a regular monthly benefit if, because of illness or injury, you are unable to work, resulting in a loss of earnings. It can also apply if you are not in paid work and because of illness or injury you are unable to carry out the things in everyday life.

* Terms and conditions apply. This information is summary only. You will receive a full policy document upon application. This policy will set out the terms, conditions and limitations of this product.

All insurance policies are underwritten by AIG Life – one of the largest insurers in the UK.

Adviser Contact Form

Adviser Contact Form

Only complete and submit this form if you want to be contacted by a Financial Services Adviser

Nick Clarke (Firm number 592549) is an Appointed Representative of Health-on-Line Company UK Limited trading as SecureHealth. Health-on-Line Company UK Limited are authorised and regulated by the Financial Conduct Authority and are a wholly owned subsidiary of AXA PPP Healthcare Group Limited, who are part of the global AXA Group.

For 14 years Nick Clarke has been protecting individuals and business with a range of solutions to protect people’s lives, families, homes, income and businesses.

He has worked at Standard Life and is currently with Securehealth, which is part of AXA PPP Healthcare (part of the AXA Global Group).

Nick has been protecting individuals and business with a range of solutions to protect people’s lives, families, homes, income and businesses. He is an award-winning professional who is conscientious and supportive with his customer’s needs at the heart of his business. He has a comprehensive approach and an in-depth fact find is undertaken to determine individual’s needs.

Health-on-Line Company (UK) Ltd is registered in England and Wales No. 3655704. Registered Office: 5 Old Broad Street, London EC2N 1AD

SecureHealth Head Office: 80 Holdenhurst Road, Bournemouth, Dorset, BH8 8AQ.

Telephone: 01202 057480